A Discussion on the New Prospect of the Sports Equipment Industry by Looking at the Global Age Structure

By Emmy Hsu from FRT.

The scale of the global sports equipment market is worth about 150 billion USD, and the U.S. has always been the largest market of sports and recreational products in the world. The U.S. enjoys a steady growth in the production of such products, and is still setting the sports trend in the world by having a 45.9 billion USD business volume of sports equipment in the year 2000. According to an analysis of the future of sporting goods in the U.S. by the Sporting Goods Manufacturers Association (SGMA), the Baby Boomers are aging, and more and more people who are 45 years old or older use exercising equipment. A statistics by American Sports Data points out two important trends in the fitness industry in the U.S. in the past ten years: 1. there is a significant increase in the population who go to fitness clubs, and 2. the population of mid-aged or elderly people who participate in sports is also increasing. In the last two years, the new products developed by the fitness equipment manufacturers in the U.S. contribute a lot toward the increasing sports population. In addition to treadmills, fixed bicycles and other new sporting equipments, the exercise with low physical stress are widely popular, and the equipment that promotes provides low stress exercise will become more popular in the future. More and more consumers are willing to spend more money on better sports equipment, and this is what makes it a rewarding market when the economy improves.

In the European fitness market, more and more European consumers now choose sports activities in a variety of recreational activities, and they are willing to maintain their figure and health through sports. In the fast growth of the fitness industry in Europe in the past few years, the constant introduction of new fitness equipment has helped the fitness industry to be the center of the showcase in Europe, and UK and Germany are two of the brightest stars. In the fitness equipment market in Germany, the consumers mainly pursue the fit body. As for the counterpart in UK, the main age group that purchases fitness equipment is from 15 to 34, and despite the fact that the age structure in UK is aging quickly, the market of fitness equipment is actually continuing to grow instead of withering. The reason behind this is that more and more people in the UK exercise to remain healthy, and such participation increases the age group, making the seniors the most potential customers in this market.

There is still a lot of room for development in the sports market in Poland. With more income, the Polish people now value their health more, and the demand for sports equipment is also increasing. The consumers' need is shifting from low-price products to products of better quality and higher prices, and gradually they tend to purchase higher-price sports equipment with better quality. By analyzing the entire market, we have discovered that half of the products are made by domestic manufacturers, and the other half are imported. Take roller blades for example, the consumers of all age groups are now increasing when it was commonly believed that roller blades buyers were usually below the age of 20 and would prefer cheaper models. Today, however, famous brands that are more expensive enjoy good sales volumes; people of different ages buy them, including females between the age of 30 and 35 who have higher consuming capacity.

The people in Japan who buy family fitness equipments are mostly above the age of 40. As they grow older, they are more concerned with their health, and products such as steppers, fitness bikes, massage chairs, and horse-riding simulators made by companies such as Alinco, Omron, and Matsushita are widely popular in Japan. Moreover, most Japanese houses are too small to accommodate large fitness equipment; those that take up less space or are foldable are more popular. Among a variety of fitness equipment that was exhibited in the 15th Health & Fitness Japan 2006 (HFJ), the trendy horse-riding simulators, treadmills, steppers, fitness bikes, and massaging/body-sculpting products received most popularity. The body-building exercises made possible by fitness equipment, emphasizing on stretching and muscle-building, were commonly believed as things for young people who have too much energy are now being introduced to older people or housewives in fitness classes. The popular trend of body-sculpting and health maintenance has resulted in the promotion of fitness among consumers of different age groups. Focusing on the needs of older people and safety, manufacturers are developing a variety of easy-to-use fitness equipment that have arm-rests and back supports, within which the automatic fitness equipment, made of wood, is perfect for those under rehabilitation since it eliminates physical stress.

2006 ISPO Sports Equipment Exhibition in Munich, Germany is the largest sports equipment exhibition in the world. The trend observed in this event was the combination of electronics function and fitness instruments in products. For example, Polar's wireless transfer sports outfit is able to transmit bio-data when exercising (such as body temperature, heart rate, and blood pressure) back to the central unit and such function can also be integrated with the health product market.

The population in Germany is about 86.16 million and the statistics by DSB (sports alliance of Germany) in 2001 showed that there are about 25.4 million members in their 16 federal sports alliances and more than 87,000 sports clubs. Among which, 38% are females, demonstrating the significant percentage of women in the sports and fitness market. Most people who go to fitness clubs want to control their weight and figure, thus the essential fitness and exercise products that help them stay healthy and lose weight are gradually becoming the new trend.

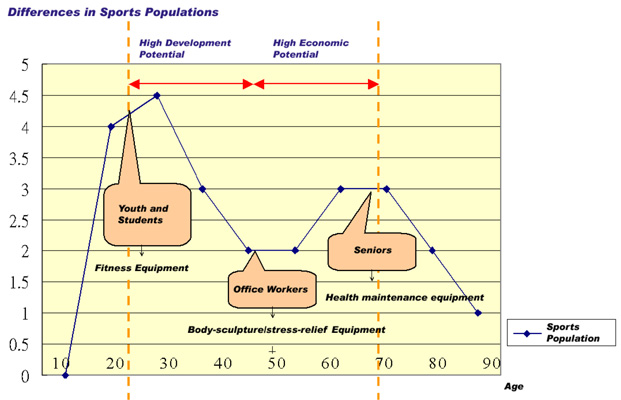

If we analyze the growth of the sports equipment industry by looking at the global age structure, we can see that the future of this industry is shifted toward the sales of body-sculpting/stress-relieving products for office workers and health-maintenance products for seniors.

However, the types of sports equipment for different age groups depend on consumers' age, sex, and physique (the habit of exercise). A consumer must first understand the nature of equipment, the techniques involved, the rules, and whether he or she can actually do it in order to prevent sports injuries. According to a research by IHRSA, there are about 39.4 million people in different types of health and fitness clubs throughout the U.S., among which the male-female ratio is 48%, 52%; the age group distribution is quite polarized: age 6-11, 4%; age 12-17, 7%; age 18-34, 34%; age 35-54, 36%; 55 or older, 19%. Generally speaking, the world population is aging, and there is more than 300 million who are 60 years of age or older, and the number will increase to 580 million in 2000 (?) and 1.1 billion in 2025, which is about half of the world population in early 1950s.

There is a significant difference

between the age groups in terms of the sports they participate in. For a child, overly repetitive sports or ones that involve jumping could damage the growth plates and hinder bone development. Therefore, the sports equipment for them should not involve lengthy or overly stressful activities.

There is actually a decrease in the number of youth who participate in sports when they are commonly believed as having tons of energy. The reason behind this could be the facts that physical education is not being valued, and the easy access of the Internet, video games, and TV programs have induced them to choose indoor activities rather than scout activities and ball games that were popular in the earlier days. Since adolescence is the most active period, fitness and sports products that involve more intense activities can be chosen based on individual physical condition.

Trend of the Age, Sports Population, and Sports Equipment

Our organs deteriorate as we age. After the age of 30, muscle strength starts to decrease, tendon strength is reduced to about half at 40, and the density of collagen is reduced by more than half after 40. Office workers who are at their prime should consider the amount of exercise they do and fully warm up before doing any sport in order to prevent ligament or muscle injuries. Women after menopause are more prone to have osteoporosis and must be more careful when doing exercise. In the female market, sports products that promise stress-relief and body sculpting are always popular.

The bone density of people who are 55 years old or older also weakens each year, and such process may be faster for those who do not regularly exercise. 25% of this age group participates in fitness activities, and this has grown by 4 times compared to the counterpart 20 years ago. The reason why middle-aged people are more likely to exercise than the other age groups could be the fact that they have more time to exercise for their health; more importantly, their doctors, medical consultants, and physical trainers constantly, almost in a hypnotic way, remind them to exercise, pushing them into exercising. Due to physical considerations, seniors have weaker coordination skills and thus should avoid intense activities and should choose sports equipment that involves health maintenance or low-impact sports.

By analyzing the global age structure, we see that the future products in the sports equipment industry will be focused on stress-relief or body-sculpting that have high development potential and health-maintenance that has high economic potential. Stress-relief or body-sculpting products will be applied in the field of sports medicine and massaging. In the field of sports medicine, when one uses the horse- riding simulators, the figure-8 movement when the seat moves back and forth helps strengthen muscles, correct posture, and reinforces the sense of balance, resulting in health maintenance. In the field of massaging, stress-relieving massage machines that blow out heated minus-ion wind combine hot wind and massage-hammers that warm up one's body, resulting in faster hypodermic blood circulation, effective removal of accumulated toxins, and relief of muscle pain. Health-maintenance equipment can be applied in the development of passive sports equipment and sports medicine. In the field of passive sports, products such as massage chairs, far infrared active-oxygen aquatic therapy work on material or physical principles that heat up one's body, facilitate faster hypodermic blood circulation, effectively remove accumulated toxins, and relax the muscle. In the field of sports medicine, health-maintenance equipment designed for seniors have back supports and arm-rests that ensure the safety of the user, and the foot cushion allows 180-degree motion that helps train leg muscles and tendons.

By analyzing the global age structure, we see that the future products in the sports equipment industry will be focused on stress-relief and body-sculpture that have high development potential and health-maintenance that has high economic potential and these products will be the new norm of the industry.

|